Free Research Articles - PART I

Research articles are provided here for the benefit of the floral industry. Many of the findings are drawn from studies sponsored and conducted solely by Prince & Prince, Inc. Other findings may be drawn from client-sponsored research, where the client has allowed release of the information for the general improvement of the floral industry. These findings are updated or expanded from time to time as information becomes available. Permission is granted to the reader to redistribute the information, provided that Prince & Prince, Inc. is identified as the source.

Article1: Business Performance Drives Customer Satisfaction and Market Share

Article 2: Key Reasons for Self/Home Usage of Fresh-Cut Flowers Explored

Business Performance Drives Customer

Satisfaction and Market Share

Feature Published in Flower News, November 9th, 2002

Drs. Tom & Tim Prince, Prince & Prince, Inc., Columbus, Ohio

Note: This article is the first in a series of articles based on the experiences of Prince & Prince in conducting marketing research for the floral industry over the past dozen years. We welcome your comments on this article series.

Over the past 12 years, Prince & Prince (P&P) has conducted numerous market studies in the floral industry for various clients (horticultural suppliers, floral importers, wholesale florists, floral retailers, industry associations, etc.). The purpose for many of these marketing studies was to focus our floral industry clients on doing the things in their business that most need improvement (from the customers' perspective) and doing the things in their business that matter most to the marketplace. By doing the things that "most matter", we mean focusing on those key business performances that most drive customer satisfaction and increase buying loyalty, resulting in higher market share for our client.

In this article, we take a broad view across ten selected marketing research projects conducted by P&P in the floral industry over the past five years, and we highlight a few key principles gleaned from these studies. While we do not divulge specific confidential information from these studies, we will show that it is the performance of the floral business that leads to increased customer satisfaction and greater market share. We will also demonstrate that businesses must know where they stand in performance relative to their competition, and know the key performance factors that most drive customer satisfaction and market share.

The Market Studies

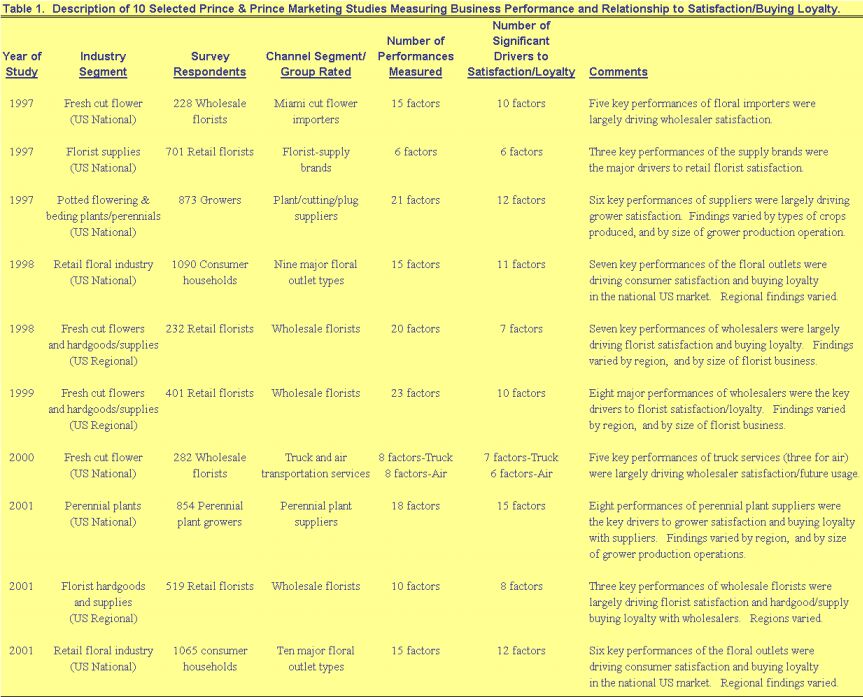

We selected ten marketing studies from the more than 50 conducted by Prince & Prince over the past 12 years. A description of these ten marketing studies is provided in Table 1. These studies are indicative of the general types of floral marketing research conducted by P&P, and cover various industry segments, including fresh cut flowers, floral hardgoods/supplies, potted flowering plants, bedding plants, and perennials. Many of our business clients call these marketing studies "channel studies", as they usually involve one channel segment (e.g. retailers) evaluating the business performance of its most immediate higher channel segment (e.g. wholesalers or suppliers). In marketing theory, this two-group channel analysis is termed a "channel dyad", but a complete channel study would potentially survey every channel dyad from floral supplier to the end consumer.

In Table 1, the selected marketing studies are sorted by the year the study was completed, ranging from 1997 thru 2001. For each marketing study, the table shows the number and type of respondents surveyed and the industry channel or group evaluated by the respondents. Across the ten studies, consumer households, retail florists, wholesale florists, and various grower segments were surveyed. These groups evaluated the business performance of retail floral outlets, wholesale florists, florist supply brands, Miami floral importers, floral transportation services, and plant/cutting/plug suppliers. Our ten selected studies broadly represent the US floral industry channel at large.

In measuring business performance, Table 1 shows the number of factors measured (ranging from 6 to 23 factors), the number of performance factors that were significant drivers to customer satisfaction/buying loyalty (ranging from 6 to 15 factors), and brief comments about the findings. A "performance factor" is defined by a group of performance attributes that are inter-related in the minds of the survey respondent. For example, in many of our studies, we evaluate the factor "salesforce performance", which may encompass individual measurements of the level of courtesy, knowledge, and competence of the company's salesforce, as perceived by survey respondents. Likewise, the performance factor "cut flower quality" may measure the perceived quality and freshness of the company's roses, carnations, novelty cut flowers, tropicals, etc. Thus, the performance factors measure specific domains of floral business performance, and each factor is usually based on several measurements in the survey.

Our measurement of customer satisfaction is usually based on a 7-point rating scale anchored by the words "Very Dissatisfied" to 'Very Satisfied", and the measurement of "buying loyalty" represents a proportion of total purchasing allocated to a particular competitor in the channel or group evaluated. Collectively, the customer satisfaction measure and the buying loyalty measure comprise our "Satisfaction/Loyalty" component. In our analysis of this market evaluation data, we employ marketing models that use structural equation modeling (SEM), a mathematical research tool, to derive the key performance drivers to Satisfaction/Loyalty.

Performance Drives Satisfaction

Across all ten marketing studies in the floral industry, numerous performance factors of the floral business were found to be significant drivers to customer satisfaction and buying loyalty (Table 1). This means that for each industry segment studied, the perceived business performance among floral competitors varied, and that for many performance factors, the variation in performance was significantly related to the variation in customer satisfaction/buying loyalty. In most of these studies, about 90% or more of the variation in the satisfaction/loyalty component was accounted by the variation in the measured performance factors. Thus, these market studies reveal that higher business performance in the floral industry leads to higher customer satisfaction/ buying loyalty, resulting in higher market share. And conversely, the findings show that lower business performance in the floral industry leads to lower customer satisfaction/ buying loyalty, and lower market share.

Comparison of the number of factors measured in each study with the number of significant drivers indicates that not all measured performances of a floral business are significant drivers to satisfaction/loyalty. Furthermore, the comments in Table 1 suggest that a smaller number of critically important performance factors are the key drivers to satisfaction/loyalty. This is an important finding, for it strongly suggests that management can largely waste resources by trying to improve "everything".

These market research findings call for management to focus resources on the critically important performances that matter most to the marketplace. If our client is performing poorly (compared to the market competition) on a performance factor that is a key driver to satisfaction/loyalty, this will be directly apparent in its comparatively low market share. However, poor relative performance on a factor that is not a key driver will have little or no impact on market share. This important knowledge of key drivers may come from sources internal to the business, from long-term market experiences, or from researching the market. In our consultation with floral management before and after conducting market research, we note that floral management rarely has knowledge of all key performance drivers, or knowledge of the importance ranking of those drivers. In addition, our consultation has shown us that management largely over-estimates its own business performance, while under-estimating the market strengths and strategies of the competition, which are readily revealed in the market findings.

Summary

Overall, these marketing research findings suggest that businesses in the floral industry need to focus inward on their own business performance to gain customer satisfaction, to increase buying loyalty, and to gain higher market share. Furthermore, businesses must know the key driving factors that lead to increased customer satisfaction and higher market share. Without this knowledge, we believe that many businesses will continue to expend resources in areas that are not truly needed or valued highly by the marketplace, while coming up short in truly important areas. By focusing resources on the things that most matter to the marketplace, both suppliers and customers benefit. Customers become more satisfied with the products & services of their suppliers, and are likely to buy more, while suppliers garner a larger "slice" of the marketplace pie. In the floral industry, business performance truly drives customer satisfaction and market share.

In our next article in this series, we will show that the key drivers to customer satisfaction/buying loyalty are not constant, and tend to vary from market to market, and from one channel segment to another.

About the Authors. Drs. Tom and Tim Prince, formerly of The Ohio State University, are brothers and co-founders of Prince & Prince, Inc., a leading marketing research specialist in the floral and green plant industries. Prince & Prince has completed more than 50 major marketing research reports for the floral and floral-related industries in the US, and has also conducted floral marketing research in Canada, the United Kingdom, Holland, and Germany. They conceptualize and implement market studies and product tests for floral and green-plant suppliers, floral importers, wholesale florists, retail florists, and floral-industry associations. For more information about their marketing research, visit their web site at www.FloralMarketResearch.com, or contact Prince & Prince, Inc., PO Box 2465, Columbus, OH 43216-2465, phone/fax: 614-299-4050.

Key Reasons for Self/Home Usage

of Fresh-Cut Flowers Explored

Drs. Tom & Tim Prince, Prince & Prince, Inc., Columbus, Ohio

Published in Cenflo's "The Flower Book", January, 2002

( Please contact Cenflo.com for information about The Flower Book )

As part of its overall mission to evaluate the Flower Promotion Organization (FPO) ad campaign, Prince & Prince has investigated the key reasons consumers identify for their self/home purchases of fresh-cut flowers. This market research, sponsored by the FPO, utilized controlled market experiments throughout the US to evaluate consumers’ awareness and responsiveness to the FPO cut-flower ad campaign, and consumers’ cut-flower purchasing behavior. The research obtained responses from more than 5,000 randomly-selected floral-buying households in the top populated metro areas of the US in August, 2000, November, 2000, and April 2001.

In this reporting, we identify the key consumer reasons given for self/home purchasing of fresh-cut flowers for those surveyed households that had bought fresh-cut flowers in the prior three months of the three study periods (May-July, 2000; Aug.-Oct., 2000, and Jan.-Mar., 2001). In order that the survey results are not influenced by the on-going FPO ad campaign, the survey data analyzed and reported here are from cut-flower purchasing households in the top 40 US metros not currently influenced by the FPO ad campaign (See Table 1 for "control markets"). Overall, the survey results from these markets indicate that the top identified consumer reasons for self/home purchasing of fresh-cut flowers are largely the same key motivations depicted and portrayed in the FPO advertising campaign.

Survey Results

Figure 1 shows that the top consumer reason for purchasing fresh-cut flowers for self/home usage is to decorate and brighten the home. This reason was cited by about two-thirds of floral-buying households in the top metro areas, and far exceeds the other reasons measured in the consumer research. The other reasons cited for self/home usage of cut flowers were for holiday or special occasion (33%), adding color to the home (29%), lifting mood (28%), spur-of-the-moment (25%), bringing nature indoors (22%), when having company over (19%), as well as a smattering of other reasons identified by the survey respondent (5%).

The key finding of consumers using fresh-cut flowers for home decoration reiterates the need for the floral industry to market a full spectrum of cut-flower colors. This should be done so as to coordinate and/or contrast with the numerous interior-décor color themes of homes throughout the nation. This may mean more regionalized color offerings, as the colors should cater to the dominant interior-décor colors of specific markets. The findings also indicate that the flower colors are used to brighten the home, thus suggesting bright and bold color offerings.

Consumer Segments

To gain a fuller understanding of the reasons why consumers buy fresh-cut flowers, we segmented the overall survey findings by consumer demographics (gender, age, and household income) and by the seasonal period in which the three surveys were conducted. This provided us profiles of consumer groups leading and trailing the cut-flower purchasing trends.

Figure 2 reveals that some of the key consumer reasons for purchasing fresh-cut flowers for the home do vary somewhat across the seasons throughout the year. While the top reason of home decoration remains somewhat stable across the three study periods, self/home usage of fresh-cut for "holiday/special occasions" and "to lift mood" are relatively higher in the Winter (Jan.-Mar.). Buying cut flowers on the "spur-of-the-moment" and when "having company over" are relatively higher in the Spring to early Summer periods (May-July).

Females were more likely to cite the reasons "home decoration", "lift my mood", and "bring nature indoors", when compared with males (Figure 3). This data strongly supports the targeting of females for an advertising campaign focused on self/home usage of fresh-cut flowers. Males were more likely to cite "other reasons" for purchasing cut flowers for the home, including reasons to express love.

Figure 4 shows that about 70% of consumers under the age of 65 cited "decorate/brighten my home", while those aged 65 and older were significantly less likely to use fresh-cut flowers for home decoration. This data suggests somewhat of an age barrier for self usage of fresh-cut flowers, with the lead reason dropping significantly for a consumer age group that is projected to grow rapidly in America. Younger consumers under the age of 25 were most likely to cite "holiday or special occasion", "lift my mood", and "spur-of-the-moment", when compared with the other age groups. This data suggests that the youngest consumers respond keenly to both impulse and special occasion/ holiday promotions for fresh-cut flowers.

The highest income group, with annual household incomes of over $75,000, were most likely to cite "decorate/brighten my home", "add color to my home", and "having company over" as key reasons for purchasing fresh-cut flowers (Figure 5). In general, these three reasons diminish at lower income levels. This data supports the targeting of higher-income consumer groups for an advertising campaign focused on self/home usage of fresh-cut flowers.

Displaying Fresh-Cut Flowers in the Home

In addition to identifying key reasons for purchasing, the market research also investigated where floral-buying consumers display fresh-cut flowers in the home (Figure 6). Overall, the top two areas receiving nearly identical majority scoring were the "living room" and "dining room", with about 57% of floral-buying households reporting such areas. These two areas were followed by "kitchen" (42%) and "family room/den" (21%). The other areas, including "bedroom", "porch/patio/deck", "bathroom", "home office", and "other", received much lower scoring, with less than 15% of floral-buying households displaying cut flowers in such areas.

Summary

The major reasons for consumers’ self/home usage of fresh-cut flowers revolve around three major themes: home decoration, holiday/special occasion, and adding color to the home. A target consumer group with highest likelihood of cut flower purchasing for self/home usage appears to be high income females under the age of 65. These are the same consumer groups currently being targeted by the FPO with the on-going ad campaign. Survey findings also indicate that fresh-cut flowers purchased for self/home usage are primarily displayed in areas of the home devoted to consumer socializing, dining, and food preparation/eating.

About the FPO. The Flower Promotion

Organization (FPO), an alliance between Colombian and American flower

growers, was created to expand the US market for all cut flowers. The FPO

is committed to increasing short-term and long-term consumer demand for

fresh-cut flowers. The FPO's program, "Flowers. Alive with

Possibilities" (TM), currently runs in 5 demonstration markets

(Detroit, Chicago, Philadelphia, Houston and San Diego). The

FPO has announced that it intends to expand into additional markets, with

Minneapolis/St. Paul to begin in 2002. Contact William R. Carlson

(989) 834-1322 for more information.

|

Table 1. Control Markets (Top 40 US Metros with No TV Overlap of FPO Ad Campaign) |

|

|

|

|

|

Washington-Baltimore |

Salt Lake City-Ogden |

|

San Francisco-Oakland-San Jose |

Greensboro--Winston-Salem--High Point |

|

Boston-Worcester-Lawrence |

Nashville |

|

Atlanta |

Buffalo-Niagara Falls |

|

Miami-Fort Lauderdale |

Hartford |

|

Seattle-Tacoma-Bremerton |

Providence-Fall River-Warwick |

|

Minneapolis-St. Paul |

Memphis |

|

St. Louis |

Rochester |

|

Denver-Boulder-Greeley |

Raleigh-Durham-Chapel Hill |

|

Pittsburgh |

Jacksonville |

|

Tampa-St. Petersburg-Clearwater |

Oklahoma City |

|

Portland-Salem |

West Palm Beach-Boca Raton |

|

Cincinnati-Hamilton |

Louisville |

|

Kansas City |

Richmond-Petersburg |

|

Norfolk-Virginia Beach-Newport News |

Dayton-Springfield |

|

Orlando |

Greenville-Spartanburg-Anderson |

|

Columbus |

Birmingham |

|

Charlotte-Gastonia-Rock Hill |

Albany-Schenectady-Troy |

|

Las Vegas |

Fresno |

|

New Orleans |

Tucson |

|

|

|

About P & P Reports for Sale Custom Research Contact Us

Prince & Prince, Inc. PO Box 2465, Columbus, OH 43216-2465 phone & fax: 614-299-4050

E-mail: P-and-P@worldnet.att.net

TO TOP OF PAGE